Prince’s unexpected demise in 2016 activated numerous court proceedings. First, Probate files had to be filed in court docket for the reason that Prince died with out a will. He did not have a wife or husband or small children, but Prince had 50 %-brothers and fifty percent-sisters. There were numerous statements from the estate, and some promises by the estate much too, including a wrongful dying case that was sooner or later dismissed. As takes place when an individual with important property dies devoid of a will, probate is high priced and protracted. A single of Prince’s sisters, Tyka Nelson, offered a portion of her share of the estate to Primary Wave, a music publisher. A different sibling also manufactured a deal with Major Wave. And then there are taxes. Money lousy or not, estates face the federal estate tax of 40%. A federal estate tax return need to be filed, and while income tax audits are exceptional, just about each individual sizable estate is audited by the IRS. Prince’s estate claimed a taxable benefit of $82 million to the IRS, but the IRS wants a lot more, and estate tax fights can go on for many years. How extensive? Well, Michael Jackson died in 2009, and his IRS estate tax fight is nevertheless going on.

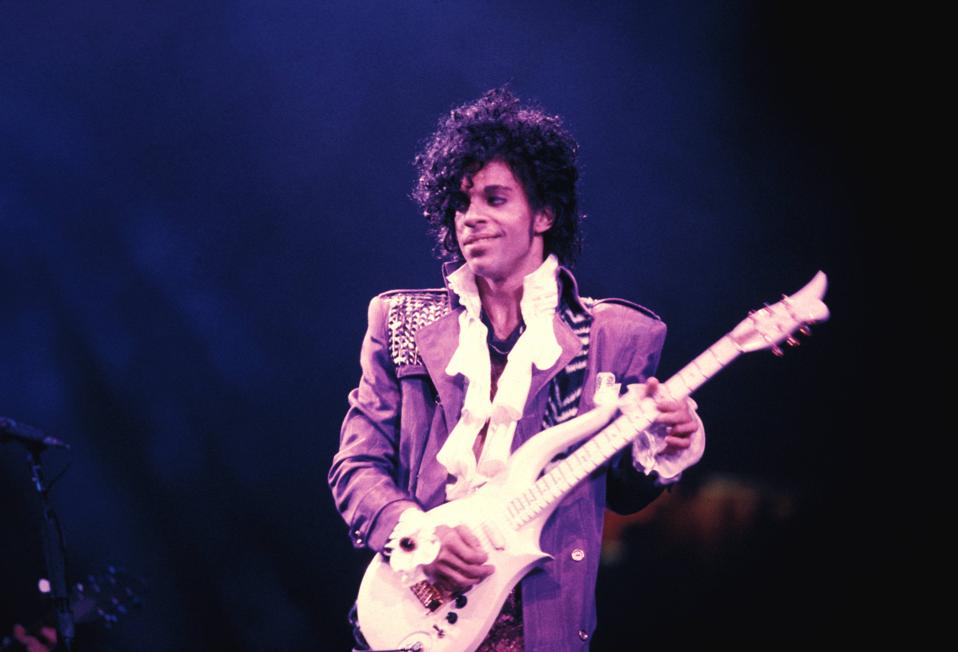

UNITED STATES – SEPTEMBER 13: RITZ CLUB Picture of PRINCE, Prince undertaking on phase – Purple Rain … [+]

Papers submitted by Prince’s Estate in U.S. Tax Court demonstrate that the estate noted a taxable value of $82 million, but the IRS claims that the estate’s taxable benefit is truly a whopping $163 million. Hence, on best of the tax that the estate is now reporting, the IRS wants an extra $38.7 million a lot more in taxes. The IRS is disputing the price an a extensive array of assets, from real estate, to graphic legal rights to pursuits in corporations. In practically each and every circumstance, Prince’s Estate obtained appraisals to substantiate the noted benefit, but the IRS has its personal appraisers who say it is all worthy of additional, a large amount more. Sudden celeb fatalities can make the relaxation of us assume about what files we need to have to have in place. The tax and fiscal hassle of probate or intestacy can be big, even for usual sized estates. When you increase the kind of zeros that go with a mega-successful entertainer, the failures can seem much extra palpable.

For the reason that he experienced no will, we know very little of what Prince desired to have occur to his fairly substantial estate. Of course, even a will may perhaps not address everything. Heath Ledger experienced a will, but it was 5 many years old when he died. It gave his parents and sisters his $20 million estate, failing to mention Michelle Williams or their child. After James Gandolfini died at 51, reviews said his will clumsily despatched $30 million of his $70 million to the IRS. The stories really should make tax advisers and estate planners cringe. At least a will would have revealed what Prince desired, but a will is general public. Very, Seymour Hoffman, Ledger and Gandolfini all finished up with wills in probate, which is general public, costly, time consuming and unwanted. A will nevertheless has to go by the courts, but a revocable have faith in disposes of your assets outside the house court. You continue to do a simple pour-around will. It provides all the things to the revocable rely on. It is basic and private.

Advisers frequently say you ought to update wills and revocable trusts for big gatherings like births, marriage, divorce, etcetera. You can give an unlimited amount to your husband or wife tax-no cost throughout life or on loss of life. Prince’s estate may experience a 40% estate tax, but it is exciting to contemplate what would have occurred had he been married and specified his estate to his partner. The solution? No federal estate tax, at the very least not till the death of his husband or wife. The existing federal estate tax legislation claims he can (by will or intestacy) give $11.58 million tax free to any individual, a whopping $23 million for a married couple. But if your estate is $82 million as Prince’s estate reported—even without the doubling to $163 million claimed by the IRS—you are likely to pay out millions in estate tax. The current federal estate tax fee is 40%. In 2016, Hillary Clinton and Bernie Sanders proposed a 45% estate tax price, and Hillary desired as a great deal as 65% for really prosperity estates. Vice President Joe Biden has recommended slashing the 11.58 million per man or woman exemption down to $5 million, and repealing action up in basis on demise for profits tax applications.

More Stories

What to Look For in a Commercial Construction Contractor

How Can An Heir Borrow Against Inheritance?

What Is Commercial Construction?