The information of the tax fraud scheme perpetrated by Chabad of Poway’s Rabbi Yisroel Goldstein has stunned the nation.

Support Moments of San Diego’s advancement

with a little every month contribution

Amid the ancillary inquiries further than the profits tax fraud: Why hasn’t the County of San Diego absent after back property taxes, fascination and penalties for the religious exemption claimed on Goldstein’s residence?

First, some track record. Rabbi Goldstein was the non secular chief of Chabad of Poway. More than a interval of yrs, he engaged in huge tax fraud, essentially laundering charitable contributions back to donors in exchange for a 10% payment.

On Nov. 24, 2019, Goldstein pleaded guilty to many counts of tax fraud and agreed to repay around $3.5 million to many companies. He was also terminated from Chabad of Poway and Chabad-Lubavitch (the worldwide mother or father firm). He is set to be sentenced April 26, 2021, by Choose Cynthia Bashant.

As part of this scheme, Goldstein utilized a shell group, Congregation B’Nei Yisroel. Given that 2002, this group was granted the standing of a nonprofit spiritual organization dependent on Goldstein’s representations.

Appropriately, the authentic estate owned by Congregation B’Nei Yisroel was granted exemptions from house taxes. Nonetheless, given that the firm may possibly not have skilled as a legit spiritual firm, house taxes may be past due.

The Path

Congregation B’Nei Yisroel was classified as a nonprofit spiritual group in 2002. Nevertheless, on July 14, 2020 (Scenario No. 20CR1916-BAS), U.S. Lawyer Robert S. Brewer Jr. discovered the “congregation” as a shell corporation set up entirely to defraud taxpayers for Goldstein’s particular benefit. Considering that the group was hardly ever a religious corporation, the properties it owned were not used for spiritual needs. The homes were being Goldstein’s residence (claimed as “parsonage”) and adjacent land (claimed as a “parking lot” for the congregation).

The very first filing for Welfare Exemption, Assert For Exemption From House Taxes, was filed by Goldstein on May 8, 2003. He claimed that the home was used as portion of a “Religious Establishment – Synagogue & Religious College.”

As help for that declare, Goldstein noted tax-exempt standing granted by the Franchise Tax Board (California state earnings taxes) dated Feb. 10, 2003, and the Inside Earnings Provider (Federal profits taxes) dated Dec. 30, 2002.

Every 12 months since 2003, Goldstein attested that the “congregation” continued its tax-exempt position, stating that the organization’s charitable function was “social services” and that the religious objective was “housing of religious personnel.” The exact same attestation kind was signed once more for 2020, but this time, it was signed by Goldstein’s son, Rabbi Mendel Goldstein.

Existing Position

On July 31, 2020, Linda Tartakoff, a private citizen, wrote to the Board of Equalization with concerns about the residence tax-exempt standing of Congregation B’Nei Yisroel.

On Aug. 8, 2020, the County Assessor’s Welfare or Veterans’ Organization Exemption Organizational Clearance Certificate Discovering Sheet showed that Congregation B’Nei Yisroel’s exempt standing was suspended. Based on its overview of the organization, the organization’s exempt specifications have been “incomplete”, “N.F.S” (no harmony sheet) and “N.O.S.” (no working statement).

Therefore it seems that the B’nei Yisroel home tax exemption was suspended as of August 2020. Having said that, no point out is produced as to prior yrs.

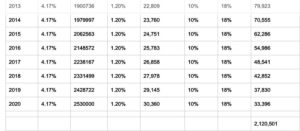

The situation at hand is basically a make any difference of an unique claiming an exemption for a personalized residence considering that 2003. In accordance to public documents, the home’s assessed worth is about $2.1 million, and the land’s assessed price is about $430,000. Own house topic to the exemption was valued at $36,500.

For the serious assets only, assuming an common 4.17% appreciation fee, 1.2% property tax level, 10% late penalty and annual curiosity at 18%, the full delinquent home taxes are properly over $2 million!

This is certainly truly worth pursuing and ideally the county will do so.

Sheryl Rowling is a licensed community accountant, personalized economical specialist and former principal of Rowling & Associates. Donald H. Harrison is editor of San Diego Jewish Entire world. A version of this piece originally appeared on San Diego Jewish Earth, a member of the San Diego On line Information Affiliation.

Impression: County Should Go Immediately after Poway Rabbi’s $2M in Unpaid Assets Taxes was last modified: October 8th, 2020 by

>> Subscribe to Situations of San Diego’s cost-free each day electronic mail e-newsletter! Simply click below

Comply with Us:

More Stories

What to Look For in a Commercial Construction Contractor

How Can An Heir Borrow Against Inheritance?

What Is Commercial Construction?