Source: Opendoor Brand Assets

Source: Opendoor Brand Assets

Opendoor recently became publicly traded through a merger with the SPAC, Social Capital Hedosophia Holdings II (NYSE: IPOB). In my opinion, IPOB, and Opendoor by extension, offers an excellent play on the disruption of the real estate industry. Opendoor has demonstrated product-market fit, improving unit economics, and a business model that can scale at a high growth rate.

The company’s sales grew ~150% yoy in 2019, and while the pandemic has led to a major contraction in home sales in the past quarter, the overall housing market appears to have mostly recovered to pre-pandemic activity as of August. Given the SPAC merger and other private funding, Opendoor has accumulated enough financial ammunition to continue tackling their proclaimed trillion-dollar market opportunity with some vigour. The company has the potential to become the dominant marketplace for house sales throughout the country and is worth an investment at the current valuation.

Disruption for the Real Estate Industry Has Arrived

When it comes to innovation, or technology generally creeping its way by creative disruption across industries, real estate has been fairly late to the game. The larger an industry’s regulatory obstacles and hurdles, the later the digital transformation has taken over. Online e-commerce has been around for decades, social media adoption was frictionless through the early 2000s, and cloud computing enabled a host of fast-moving innovators and pioneers that have made it big in hindsight. As tech platforms and digital transformation charged forward, digital transformation ended up making its way into more fragmented, physical realms and services. Uber (UBER) has created a widespread unified taxi platform, Teladoc (TDOC) has taken doctor consultations online, and Square (SQ) is creating a digital-first financial services ecosystem. Healthcare, Financial Services, and Real Estate remain among the more complex areas to navigate and thereby present massive opportunities for entrepreneurs that take them on early with lesser competition around.

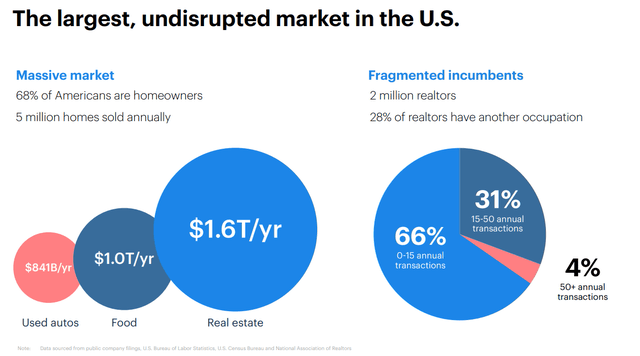

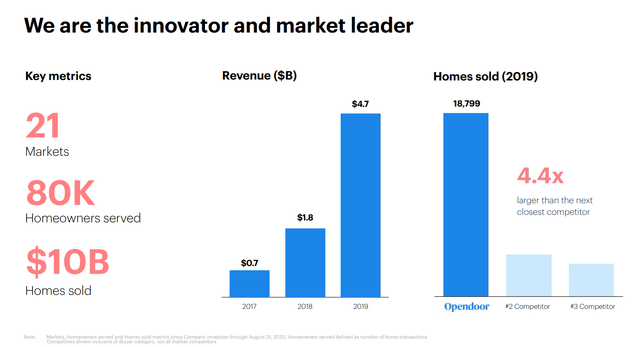

Source: Opendoor Investor Presentation

Any real estate dealings, and by extension the buying/selling of houses is an often tedious process. Valuations, inspections, repairs and renovations, and finding someone to take on the other side of a transaction is full of obstacles and is a lengthy procedure that costs more time and money than it should. “iBuyer” companies aim to take all that friction out of the homeowner experience by offering a full-service real estate stack, directly buying off a property from a seller and handling the rest. This model and its prevalence are in early innings as far as public companies go. The sheer size of the US real estate opportunity is immense and remains largely undisrupted by the iBuyer model that has gained some strong product-market fit as a proof of concept so far.

The SPAC Reverse Merger & PIPE Investments

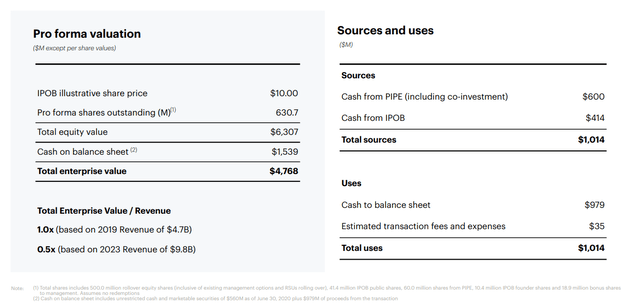

Source: Opendoor Investor Presentation

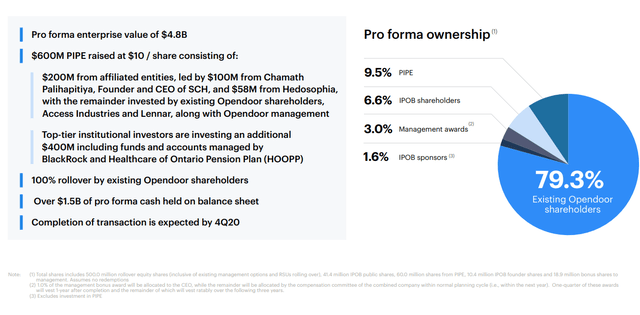

On September 15, the Special Purpose Acquisition Company (SPAC), IPOB (alt. Social Capital Hedosophia Holdings II) entered into an agreement to merge with Opendoor through a combination of stock and cash financing. Opendoor’s implied valuation based on the merger terms was $4.8B, roughly 1.0x EV/ 2019 Revenue (Press Release). The transaction was further supported through a $600 PIPE (Private Investment in Public Equity) at $10.0 per share. The PIPE included $200m from Social Capital Hedosophia Holdings affiliations itself, including Chamath Palihapitiya (Founder of Social Capital), Hedosophia, and existing Opendoor Shareholders. The balance of $400m was raised through institutional investors.

One can think of this as a late-stage growth PE/VC round, with public market investors cut in on the deal. Part of Social Capital Hedosophia’s vision is to take tech companies public earlier and offer an alternative to the traditional IPO, considering the public-market appetite for growth. IPOB is therefore an exchange-traded investment vehicle for the public markets to gain exposure to Opendoor. As one would consider this to be early-stage as far as public market businesses go, there might be further funding rounds and public offerings in the future as only 6.6% of the shares are currently public.

Opendoor

Source: Opendoor

Opendoor uses technology to help people buy, sell, or trade-in homes. They buy the homes themselves, hold it and pay interest while making minor renovations, and then sell it. One might think of this as home-flipping, or taking advantage of distressed properties, although the company explicitly states that they only consider properties in good condition meeting their criteria. The majority of their gross profits are generated from service fees rather than property gains, similar to that of a real estate agent. Opendoor charges a few percentage points (~6-12%) based on the property, transaction, and risks associated. They can match fair market values for houses and traditional real-estate agent commissions while also significantly simplifying the process for customers. They’ve also offer peripheral services which are becoming meaningful additions to revenue such as Title & Escrow and Home Loans. As of end 2019, they’re the market leader based on the number of homes sold throughout the iBuyer industry.

Source: Opendoor Investor Presentation

While Opendoor unifies real-estate procedures through software and economies of scale, it doesn’t qualify as a pure technology company in my opinion. It is more of a consumer services company that utilizes technology extremely well. Going by their growth, however, they appear to present the tech-like scalability and network effects of a disruptive company. Operations teams, advisors, user experience design, and data science applied en mass contribute to the company’s competitive advantages. The moat widens with its scale as its network effects are more effectively utilized.

More importantly, we have some track record of the company benefitting from economies of scale and margin expansion. This is a crucial point as we’d like to particularly avoid a Softbank-WeWork scenario where the new disruption could only scale by burning venture capital money. Opendoor on the other hand benefits from more efficiently utilized agents, cost savings on home spend, discounted bulk purchases of home materials, and thousands of sub-contractors on their platform. Opendoor is yet to prove itself as a mature business model, but these facts should provide some comfort to investors worried about another dodgy real-estate business masquerading as a tech company.

Investors should note that as attractive as a trillion-dollar opportunity sounds, the iBuyer model is built on purchasing and selling homes. It is a highly capital-intensive business where revenues are inflated as they account for home sales, while gross margins remain extremely low. Adjusted Gross Margins, according to Opendoor’s historical financial performance, has been in the 6-9% range. This isn’t expected to change much going forward and investors should expect single-digit gross margins to continue in the coming 2-3 years.

Opendoor vs Zillow, Middleman vs Matchmaker

It is important to note that Opendoor is a middleman and not a matchmaker. By this, I mean they buy and own the houses directly rather than function as a real estate broker at scale. What are the advantages of this model? It makes a major difference for the end customers, the homeowners. If I can get a cash offer up-front, and get my house sold quickly without worrying about repair work and renovations, that’s a huge value add in my opinion. If I need the cash to put down a payment on my next house before it gets snatched up by the market, Opendoor solves that problem. While a matchmaker might eventually get me to the right potential buyer, it far from removes the friction and speed to closing the deal. When considering both models, as long as I’m getting a fair value which Opendoor can provide, I’d go with the pain-free solution. This approach defined Opendoor’s original vision, which they’ve been executing on with some success.

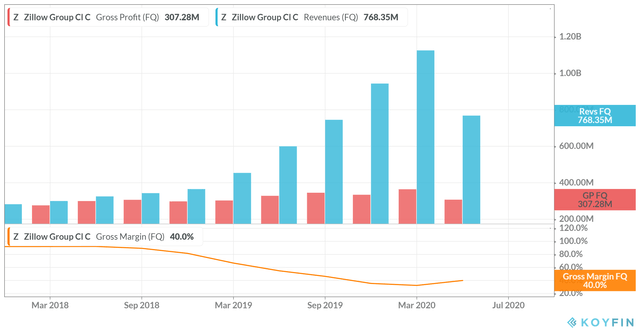

Zillow, on the other hand, has historically been more of a matchmaker and has recently transitioned to also becoming buyers/sellers of properties themselves. If I had to guess, they recognised the true value of the iBuyer model and got in the race before being disrupted. This is primarily why Opendoor is the leader in the iBuyer market despite a lower enterprise value, as Zillow’s iBuyer segment is only a fraction of its total business that features other real-estate services. As one would expect, Zillow’s revenues surged while its gross margin declined once it began doing this. This can be observed from the graph below:

Source: Koyfin; Zillow Revenues, Gross Profits, and Gross Margins across Fiscal Quarters

The market has rewarded Zillow with an impressive share price rally even though absolute gross profit figures have only inched forward. From a strategic point of view, the company should be commended for using its existing network effects as a diversified online retail services business to expand and introduce the iBuyer model under its umbrella. Zillow has referred to this as their “Homes” segment and brand it under “Zillow Offers”. While they’re likely still #2 in the iBuyer race, they are Opendoor’s main competitive threat. They have the added advantage of using cash flow generated from their other operations to chase down the iBuyer market opportunity.

On the other hand, Opendoor has been doing this for longer than Zillow has, and are the original pioneers. The company also received fresh funding to scale thanks to the PIPE and SPAC merger. It will be interesting to see how the competition evolves. Considering it is still early innings, both Zillow and Opendoor should continue to gain market share from incumbents. I have a preference for Opendoor due to their long experience and original innovation

The People Behind The Vision

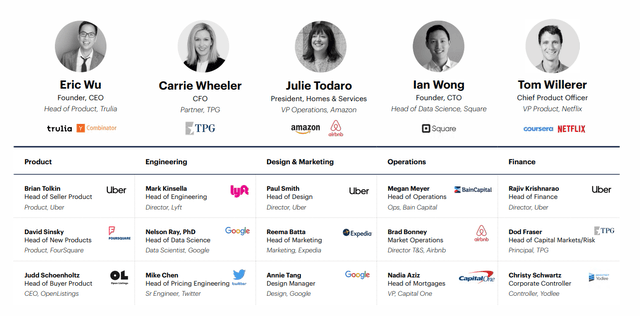

Source: Opendoor Investor Presentation

Eric Wu has had several years of previous experience in real estate tech through Trulia, which is now owned by Zillow. The team surrounding him has come from some of the most innovative category leaders around. I see Opendoor through a lens of more of a late-round VC investment, and this is where management matters more than the average public company. The team has a track record that displays operational pedigree at scale, technology leadership, and product innovation. Square, Amazon (AMZN), Airbnb, and Netflix (NFLX) are all successful businesses where the current Opendoor executives have likely learned the ropes, adapted, and gained valuable know-how.

It is also a vote of confidence that Chamath Palihapitiya, who’s heading Social Capital decided to invest in this team through the Social Capital Hedosophia II Holdings Corp SPAC as well as put in an additional $100m as an affiliate. That is considerable skin in the game. Social Capital Holding’s Gross IRR from 2011 to 2019 is 32.9% going by their latest annual letter. Before his investing career, Chamath was part of the pioneering team at Facebook (FB) that built the viral growth engine that led to its worldwide global network. Within the VC world, he’s known for being a contrarian with his viewpoints which is an attribute I particularly admire. There are only so many Enterprise SaaS and Social Media companies that are going to make it large and enough capital in both the public and private markets to chase them. Real Estate tech is novel, and newer business models like iBuyers, make for refreshing changes in the high-growth landscape that often go misunderstood by the public markets. That is where the opportunity for alpha occasionally lies.

Growth & The Housing Sales Rebound

A key concern, especially given the pandemic, is the uncertainty regarding the growth prospects for Opendoor. The company’s latest investor presentation provided financial data and self-reported projections on home sales, revenues, and profit margins.

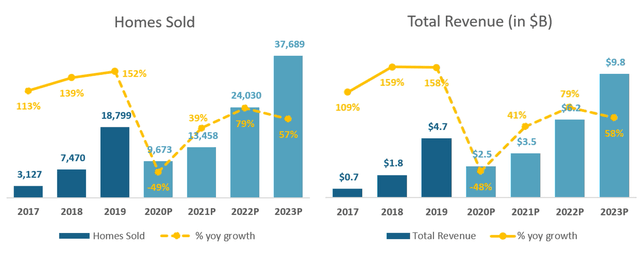

Source: Author, Recreated using data from the Opendoor Investor Presentation

Opendoor halted home purchases in March, let go off a third of its employees in April, and resumed purchases in May (Source). By July, they had mostly de-risked their balance sheet and reduced their inventory significantly. The 2020P figures the company provides should a 49% yoy contraction in annual homes sold, with similar revenue figures. 2021 is projected as a positive growth year once again, followed by further acceleration in 2022.

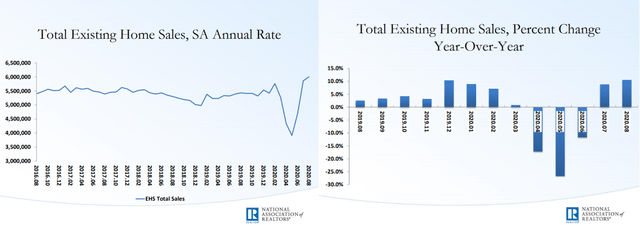

The major driving factor behind the valuation should appropriately be the home sales and sales growth, so investors will need some conviction that projections are somewhat accurate in the face of macro headwinds and disruptions. Fortunately, we have alternative data that is quite reassuring. I dug through home sales statistics on the authority on home sales data in the US, the National Association of Realtors.

Copyright ©2020 “Summary of August 2020 Existing Home Sales Statistics.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. October 6, 2020.

NAR aggregates existing home sales across the US and releases a comprehensive summary every month. The above excerpts were taken from the latest August issue. March to June saw significant disruptions while July and August, to my surprise, were back to normal levels of sales and growth. That begs the question, if Opendoor is functioning in a steady-state home sales environment once again, will the business continue to grow normally? We saw 150%yoy growth in 2019, and by that comparison, the 2020 and beyond company projections appear conservative. We should also note, that those projections were made likely some time ago when the company had less visibility on the recovery of the housing market.

If growth is limited in coming years, it likely won’t be due to the market opportunity providing macro headwinds, but instead the company’s cash balance, and scaling abilities. Opendoor has already proven that the iBuyer model can scale and that they can execute by going from $7.5B to $18.5B in revenue in a year. I’ll be surprised if Opendoor doesn’t outperform its projections comfortably given its recently acquired financial ammunition.

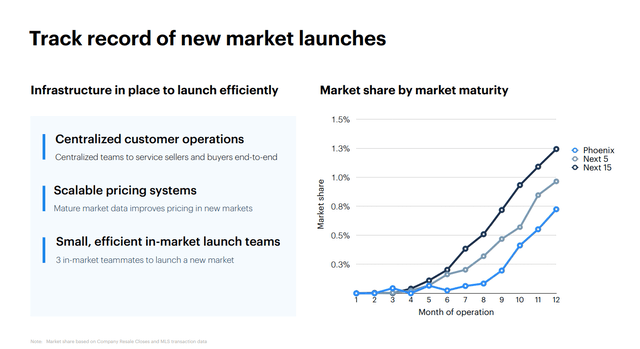

Source: Opendoor Investor Presentation

The strategy that takes Opendoor to execute $50B in Sales does not appear to be far fetched. Management and employees have learned how to accelerate market share acquisition in new launches and are already operating in 21 markets. Since 2014, the proof of concept has worked for Opendoor and has been improved and optimized.

Profitability

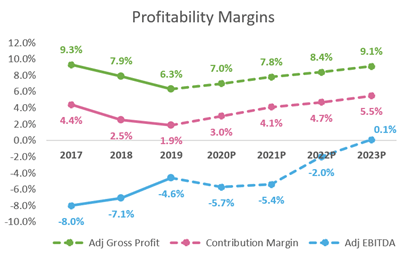

Source: Author, Recreated using data from the Opendoor Investor Presentation

Margins are expected to improve from 2020 onwards. The Long-term Contribution Margin is expected to be 7-9% with the Adjusted EBITDA Margin at 4-6%. If revenues can outperform, economies of scale benefits would be realized quicker and profitability margins should appropriately expand faster than the projected numbers above imply. Opendoor is also benefitting by taking a page out of Zillow’s old playbook and expanding into other value-added services. The company offers Title & Escrow, and Home Loans for example, which are importantly expanding gross margins. I would expect the long-term playbook to include solutions to all things real-estate.

Valuation

While Opendoor might like you to consider EV/Revenue as they’ve mentioned on their investor presentation, I think investors should stay away from that particular metric as iBuyers are a new business category with very different margins. EV/Gross Profit seems more appropriate to me at the time and helps compare the company against other high-growth stocks with different costs of revenue.

- Going by an ~$18 IPOB price multiplied by 630.7m shares, Equity Value comes to $11.35B and Enterprise Value comes to $9.81B after adjusting for $1.54B in cash

- With a reported GAAP Gross Profit of $301m in 2019, the EV/GP 2019 comes at 33x

- Let us assume that the company’s projected 2023P Adjusted Gross Profit = 2023 GAAP Gross Profit, considering the reconciliation difference between the two has been minimal historically

- Therefore, with an assumption of 2023P GAAP Gross Profit of $892m, EV/GP 2023P comes in at 11x

(Gross Profit, Shares Outstanding, and Cash figures were sourced from the Investor Presentation)

Note that the 11x figure is more in line with the company’s own sales projections. Factoring in outperformance, the forward multiples could be significantly less. It is hardly a bargain at current valuations, but if the company proves itself by executing well in the coming years, it would more than justify the current price. With a long-growth runway ahead, market leadership, and a strong management team, Opendoor is very well positioned in the iBuyer space. Given its relative youth as a public market business, I see an investment in the company as a high-risk, high-reward play. If things work out, it can be a future mega-cap.

Risks

- Opendoor fails and is bought out by a Zillow (or someone else) for a fraction of the current IPOB price

- Competition leads to pricing pressure in markets where both businesses compete

- Zillow might overtake Opendoor on account of their existing network effects and mindshare

- Macro risks are large, especially with the new-normal pandemic situation that gives us little visibility on recovering sales and a wide range of scenarios

- Systemic risks; this stock is a high-growth, new industry-defining, momentum-driven play. There are multiple valuation paradigms in which market perception can exist regarding the company until it proves itself and achieves profitability. I’d expect the market to be brutal to IPOB when it’s is just rude to other tech businesses.

Conclusion

Among the innovative public companies out there, Opendoor is one of the most ambitious businesses I’ve come across. I’m long at the current price and hold a small position relative to the rest of my portfolio. If IPOB does drop to perhaps ~$12 from a systemic event or a macro-wide drawdown in tech, that would be an opportunity to size up and add more. I expect the stock price will be particularly sentiment-driven with high vol throughout the normal market gyrations in the coming 2-3 years. As with all great long-term investments, it might take considerable patience for results to appear even if the story remains intact. The risk/reward is compelling for a business that has strong chances of taking us to the stratosphere.

Disclosure: I am/we are long IPOB, SQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

More Stories

115 Ways to Be Your Own Boss

Example of a Realtor in a Consultative Sales Conversation

Leasing-Planning for First-time Apartment Rental Expenses